Content

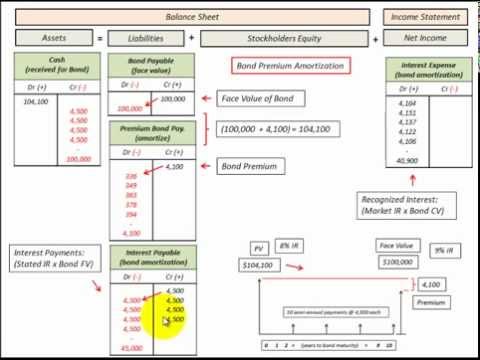

Accounting practices are not uniform concerning the actual sequence of entries made to record stock dividends. The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company’s net income. For the investor, stock dividends offer no immediate payoff but may increase in value in time. When a stock dividend is issued, the total value of equity remains the same from both the investor’s perspective and the company’s perspective. To record the distribution of this stock dividend, Stock dividends Distributable is debited and Common Stock, at par is debited. To record the declaration of large stock dividend, Retained Earnings debited by the amount of the par value of stock dividend and crediting Stock Dividends Distributable.

All stockholders receive additional shares in proportion to their current holdings; therefore, the proportion of each of them remains constant. Stock dividends issued more than 20%-25% of the number of shares previously outstanding is considered as a ‘large stock dividend’. Myers gives one share of its equity investment for every two shares of Myers Company stock held.

AccountingTools

Distinguish between cash dividends, property dividends, liquidating dividends, and stock dividends. When the par value is changed to reflect the stock split, no entry is required; however, the number of outstanding shares should be increased to reflect the split. A dividend is a payment, either in cash, other assets , or stock, from a reporting entity to its shareholders.

But here one must note that an increase in outstanding shares, it results in a dilution of the earnings per share, which will cause the share prices to fall. The market price of the stock may have risen above a desirable trading range. A stock dividend generally reduces the per share market value of the company’s stock. The board of directors establishes the date of record; it determines which stockholders receive dividends.

Journal Entries for Dividends

For instance, the quarterly dividend could have been stated as USD 2 per share. When they declare a cash dividend, some companies debit a Dividends account instead of Retained Earnings. (Both methods are acceptable.) The Dividends account is then closed to Retained Earnings at the end of the fiscal year. The date of payment indicates when the corporation will pay dividends to the stockholders. The book value per share of preferred stock is its _____ plus any dividends in _____.

- Although total equity remains unchanged, stock dividends affect stockholders’ equity and retained earnings.

- A full stock issue can be either a preferred share or common share.

- Note in Exhibit 28 that Anson reports the EPS amounts at the bottom of its income statement.

- Occurs when a stock dividend distribution is less than 25% of the total outstanding shares based on the shares outstanding prior to the dividend distribution.

- This means that for every share held an additional share will be issued.

For example, a stockholder who owns 1,000 shares in a corporation having 100,000 shares of stock outstanding, owns 1 percent of the outstanding shares. After a 10 percent stock dividend, the stockholder still owns 1 percent of the outstanding shares – 1,100 of the 110,000 outstanding shares. When it declares a stock dividend, a corporation distributes additional shares of stock to its present stockholders. A later section discusses and illustrates how the issuance of a stock dividend results in a credit to a Paid-In Capital – Stock Dividends account. The primary purpose of financial reporting is to provide information to investors and creditors. Investors use financial information in purchasing and selling of stocks, while creditors use financial information in reviewing the credit-worthiness of companies wishing to obtain loans.

Intermediate Financial Accounting 2

This entry transfers the value of the issued stock from the retained earnings account to the paid-in capital account. Preferred stockholders are paid a designated dollar amount per share before common stockholders receive any cash dividends. However, it is possible that the dividend declared is not enough to pay the entire amount per preferred share that is guaranteed—before common stockholders receive dividends. In that case, the amount declared is divided by the number of preferred shares. A company currently has 100,000 shares outstanding that are trading at $5.25 per share.

To illustrate the significance of the legal capital concept, assume a corporation in severe financial difficulty is about to go out of business. Sept. 20 Retained earnings (1,500 shares x $10) (-SE) 15,000 Stock dividend distributable – Common (+SE) 15,000 To declare a 30% stock dividend. Oct. 15 Stock dividend distributable – Common (-SE) 15,000 Common stock (+SE) 15,000 To issue the 30% stock large stock dividend journal entry dividend. Net income increases Retained Earnings, while net losses and dividends decrease Retained Earnings in any given year. Thus, the balance in Retained Earnings represents the corporation’s accumulated net income not distributed to stockholders. The retained earnings portion of stockholders’ equity typically results from accumulated earnings, reduced by net losses and dividends.